Carrier Spotlight – MedPro Group

Max Schloemann2025-04-25T13:00:55+00:00At SURGPLI, we understand that securing medical malpractice insurance is critical for protecting your practice and career.

That’s why we proudly spotlight MedPro Group. A carrier known for its exceptional A++ AM Grade, strong coverage options, 90% national trial win rate, and unwavering commitment to surgeons. If you’re a surgeon seeking reliable malpractice insurance, explore how MedPro Group meets your needs and why SURGPLI confidently recommends them.

Table of contents

Carrier Overview: Why Surgeons Choose MedPro Group

MedPro Group was founded in 1899 by a group of doctors who wanted to protect healthcare providers. As the nation’s first medical malpractice coverage provider, MedPro Group has over a century of proven experience as a reliable and trustworthy leader in the medical malpractice insurance industry. Since its founding, MedPro has helped over a million healthcare providers and has involved physician input every step of the way.

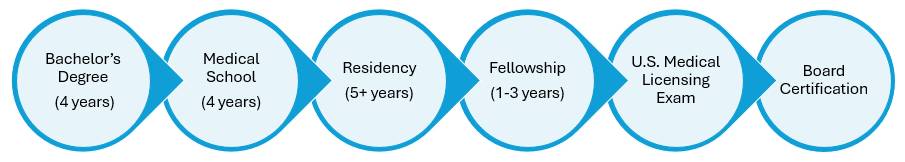

In 2005, MedPro Group solidified its authority and financial strength by becoming a Berkshire Hathaway company. Their mission is simple: provide unmatched expertise and comprehensive coverage options from residency through retirement so you can protect your name and your career.

They provide the industry’s widest coverage options, exceptional service, and unmatched financial stability.

Key Highlights:

Financial Strength:

Their excellent A++ AM Best and AA+ S&P Global ratings reflect exceptional financial stability and claims-paying ability.

Market Presence:

MedPro Group provides coverage in all 50 states & D.C.

Specialty Coverage:

Available for a range of specialties, including, but not limited to:

Free Tail Coverage:

Eligible for surgeons at retirement after maintaining coverage for just one year.

Free Cyber & Privacy Liability Insurance:

MedPro Group continuously addresses emerging cyber and privacy security issues and protects at no additional cost.

MedPro Group: Coverage & Policy Details

Understanding the nuances of malpractice insurance is vital for any surgeon. MedPro Group provides a range of policies designed to meet surgeons’ needs, offering flexibility and comprehensive protection.

1. Types of Policies Offered

2. Limits of Liability

MedPro offers both occurrence and claims-made policies, unlike most medical malpractice insurance carriers, which provide different lifetime liability limits.

4. Notable Policy Exclusions

While coverage is comprehensive, surgeons should be aware of key exclusions:

Strengths & Differentiators

MedPro Group stands out in a competitive market due to its impressive claims handling, excellent customer service, unsurpassed experience, financial stability, and flexible premium offerings. At SURGPLI, we named MedPro Group one of the Top Ten Medical Malpractice Insurance Companies for Surgeons in 2025. Here are three reasons why:

- 1

Claims Handling & Defense Strategy

✓ MedPro Group’s proactive claims management focuses on swift resolution with minimal disruption to your practice.

✓ Their high success rate in defending surgeons reflects a deep commitment to safeguarding your reputation and financial stability.

✓ With unwavering legal support, MedPro attorneys serve as trusted advisors, thoroughly preparing you for trial and defending you every step of the way. - 2

Customer Support & Resources

✓ Dedicated support teams guide you through every step of the claims process, offering personalized assistance and expert advice.

✓ Provides ongoing risk mitigation programs and continuing education resources that help you stay current with best practices. - 3

Premium Competitiveness & Discount

MedPro Group offers competitive occurrence policies and a range of discounts to help you access high-quality malpractice insurance without breaking your budget. These include:

✓ Premium discounts for completing risk management courses.

✓ New-to-practice discounts.

✓ Discounts for members of select professional associations.

Industry Reputation & Risks

SURGPLI knows that understanding an insurance carrier’s industry reputation and potential risks is essential for making informed decisions.

Known for its strong market stability and sound financial backing.

The excellent AM Best A++ and AA+ S&P Global ratings reaffirm MedPro Group’s financial health and show that the carrier has the resources to promptly meet claims obligations, even during heightened risk or economic uncertainty.

MedPro’s extensive experience puts surgeons at ease.

They’ve helped over a million health care providers since their foundation and remain an industry leader over 125 years later. Their claims team averages 25 years of experience, so you’ll know you and your career are well protected.

RISK CONSIDERATIONS:

While MedPro Group is highly rated and stable, it’s still important to consider policy exclusions and terms to ensure no gaps in coverage.

Payout Reliability and Claims Handling

Thanks to the MedPro claims team’s extensive experience, surgeons consistently report effective and efficient claims handling.

MedPro Group has an impressive track record: they’ve demonstrated a 90% national trial win rate and an 80% rate of claims ending without payment.

Regulatory Concerns & Insolvency Risks

MedPro Group’s strong ratings reflect strict regulatory compliance and financial oversight, offering reliable coverage without the insolvency risks seen in some lower-cost insurers and Risk Retention Groups (RRGs).

Key Factors for Surgeons Choosing a Malpractice Carrier

Choosing the right medical malpractice insurance carrier requires careful consideration of several important factors:

- 1

Financial Strength

Look for carriers with strong financial ratings, such as an excellent AM Best rating. Reliable ratings from agencies like AM Best and S&P provide additional reassurance of financial stability. - 2

Policy Flexibility

You can choose between a claims-made or occurrence policy depending on your needs. If you are switching carriers or retiring, consider extended tail coverage. Flexible liability limits help protect your practice as it grows and evolves. - 3

Coverage Options and Special Features

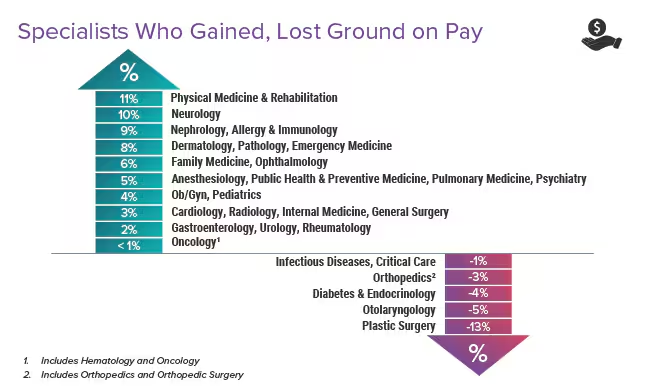

Evaluate the breadth of protections offered, including each carrier’s specialties, since some types of surgery are considered riskier than others. - 4

Customer Support and Value-Added Services

Ensure the carrier offers dedicated support throughout every stage of the claims process, risk mitigation, and continuing education resources.

How SURGPLI Can Help You

MedPro Group offers top-rated, flexible malpractice coverage with excellent financial strength and comprehensive risk management.

SURGPLI simplifies the complexities of medical malpractice insurance. Get a personalized quote today and secure your future with a carrier that aligns with your professional values.

For additional insights and resources, visit our homepage–your career deserves the best protection.

Stay In Touch